H&R Block Review 2023 | Best Software + Branch?

H&R Block is one of the biggest names in tax preparation, responsible for preparing a whopping one out of every seven tax returns that are filed in the United States.

H&R Block is one of the biggest names in tax preparation, responsible for preparing a whopping one out of every seven tax returns that are filed in the United States.

Their huge command of the market is because they have both 10,000 physical branches around the U.S. and tax software that you can use at home to prepare your return.

If you need a local branch, odds are there is one within five miles of you right now.

For anyone who wants the ease of software and the assurance of a tax pro going over their return before filing, H&R Block also offers the Tax Pro Review, which allows you to complete your return at home on H&R Block online, and choose to have a professional review of your return to make sure it is completely accurate before you submit it to the IRS.

All online clients can add Tax Pro Review to their online filing.

If you need tax software, you can quickly get it from their website at HRBlock.com. Their suite of products and services shows that H&R Block is committed to being the tax preparation provider you choose year after year.

What New with H&R Block for 2023

H&R Block updated its tax software to reflect all of this year’s federal income tax changes. They have also made adjustments to their state tax filing software.

While not directly tax-related, H&R Block came out with its banking app, Spruce. With it, you can get your refund a bit sooner if you want.

H&R Block Tax Software 2023 Review

H&R Block’s Tax Software offers a simple but thorough interface that is set up like an interview. The program asks you a series of questions to take you through the tax form.

Each question will require either simple yes or no responses or a checklist, and the software automatically populates the official tax form with your answers. The program is easy to use and makes completing your taxes much less daunting.

H&R Block offers the following features to make sure that filing taxes with their software is as convenient and transparent as possible:

Accuracy and Convenience

Rather than type in the information from your W-2, you may snap a picture of the form and upload it to the software with the W-2 Snap-a-Pic feature. Once you’ve uploaded your photo, the software puts all of the correct information where it needs to go. This improves accuracy–since it’s always possible to mistype a number when you enter the information manually–and saves time.

You can also automatically import last year’s return from any other tax prep service for free. This will help you prefill several fields in your current return, shaving time off the chore of tax prep.

Mobile App

If you prefer to do your taxes on the go, H&R Block offers a mobile app for both iOS and Android devices, as well as for Amazon Fire devices. The app is free, but once you download it, you can choose which edition of the tax preparation software you would like to use. At this point, you will be charged according to the levels listed below.

The mobile app allows you to take a picture of your W-2 forms to input the information into your filing. Once you have finished filing, you can also check the status of your return from your phone or tablet.

Refund Reveal

Throughout the process of filling out your return, the software will display exactly how much of a refund you can expect based on the answers you’ve provided. H&R Block guarantees the maximum refund, and this feature of their software helps you to see exactly how and why your refund may go up or down while you are completing your tax return.

Related: 9 Smart Ways to Spend Your Tax Refund

Expert Advice

Taxpayers who purchase an edition of H&R Block software are eligible for one-on-one expert tax advice via live chat. You can ask an unlimited number of questions of an H&R Block tax professional through the live chat, which is available for the majority of the year between 7:00 am and 7:00 pm. However, between January 15th and April 17th, they are available 24/7.

Audit Support

If you buy H&R Block software, you are also eligible for free in-person audit representation in the unlikely event that you are audited. That means that if you are audited, an H&R Block enrolled agent will help you with IRS correspondence, audit preparation, guidance through what to expect during the audit, and attendance with you at the audit itself. In short, if you are faced with an audit, H&R Block will help you manage the entire audit experience for no additional fee.

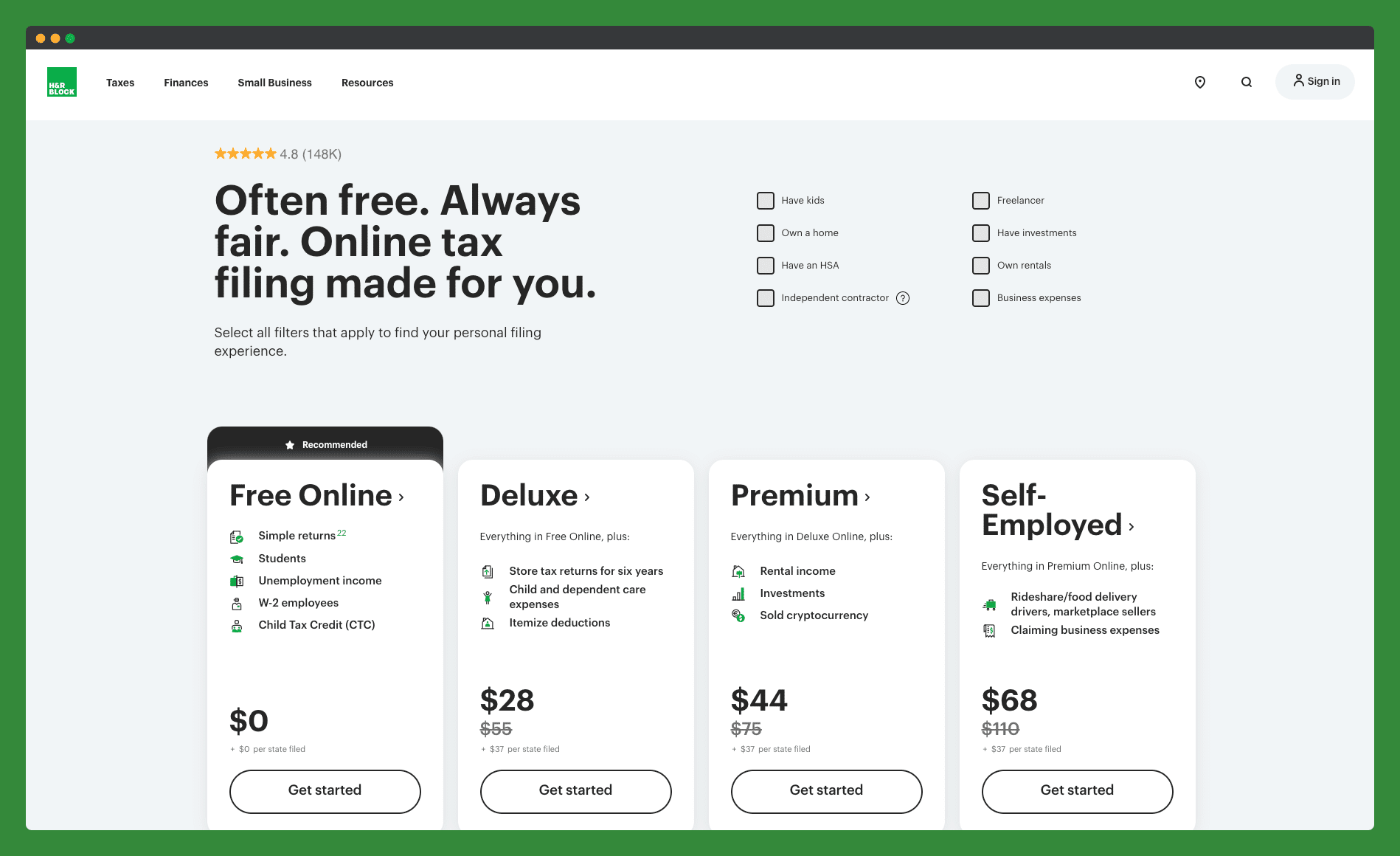

Which H&R Block Software Should You Choose?

H&R Block Free Online Tax Filing (Free for Federal and State)

This free online tax software is intended for taxpayers with simpler financial situations. If you plan to file a 1040EZ, 1040A, or 1040 form, then this software should handle your needs quite nicely.

Like most free tax software intended for this demographic, H&R Block’s Free Online Tax Filing does not allow you to itemize your deductions on the 1040 with a Schedule A.

The state version of this edition is also free, meaning you can file your taxes for $0.

Neither the unlimited expert advice nor the audit support are available for this program, however. So, this may not be the right program for you if you have any concerns or more complex tax situations.

Get started with H&R Block Free Online Tax Filing.

H&R Block Deluxe Online Edition ($28.00 for Federal, $37.00 for State)

H&R Block designed this program specifically for homeowners and investors to maximize their deductions.

It includes the features available with the free edition and plenty of guidance to help you claim the deductions for your home mortgage interest and real estate taxes. It also includes unlimited expert tax advice via chat and technical support by phone.

The DeductionPro feature will help you to track and value all the charitable donations you have made throughout the year. The investment income reporting feature will guide you through Schedule D, so that you will know you have correctly reported your investment income for the year.

In addition, you also receive free storage and access of your tax returns for up to six years with this edition, making it simpler to revisit your tax data anytime you might need it.

Get started with the H&R Block Deluxe Edition.

H&R Block Premium Online Edition ($44.00 for Federal, $37.00 for State)

Taxpayers with simple self-employment income or real estate investments must step up to the Premium edition.

The program helps you report profits and losses from freelancing or independent contracting on the Schedule C-EZ form. You can also easily report stocks, bonds, retirement, and other investment income on the Schedule D form. You can also import 1099-B investment income and report your rental property income and tax deductions on the Schedule E form.

The advanced filing calculators in this edition also help you determine the cost basis of your sales, dividends, gifts, and inheritance assets, so you feel sure that your numbers are 100% accurate.

This program also includes DeductionPro, the investment income reporting feature, unlimited expert tax advice, and an audit support guarantee. For additional peace of mind, a Tax Professional Review for an additional cost.

Get started with the H&R Block Premium Edition.

H&R Block Self Employed Online Edition ($68.00 for Federal, $37.00 for State)

Self-employed taxpayers with particularly complex situations now have a specific edition just for them. This program offers everything you get with the Premium Edition, but also includes Business Partner™, a feature that helps you get common deductions for your business. Business Booster™ is also included, which helps you write off startup costs. And Business Snapshot™, allowing you to see all your business details in one place.

The self-employed can also import Uber driver tax information, and helps you report the more complex profits and losses from freelancing, contracting, or businesses you own on the Schedule C form.

Taxpayers who are self-employed and want to make sure all their I’s are dotted and T’s are crossed may be interested in adding a Tax Professional Review.

Get started with the H&R Block Self Employed Edition or see other tax software for small business.

H&R Block Guarantees

H&R Block goes so far as to provide guarantees for their software products. They guarantee that they will provide accurate calculations on your return, or they will pay the penalties and interest charges. This is on top of their maximum refund guarantee. If you get a bigger refund with another tax preparation service, H&R Block will refund your purchase.

Customer Service

H&R Block proudly displays their customer support hotline (1-800-HRBlock) on their main support page. They also have the unique advantage of having local offices nearby to guide you through difficult questions. However, their online portal has plenty of documentation to help you through the technicalities of using the online product.

Get started: visit www.hrblock.com to start your return right now.

![How to Do Payroll for Your Small Business [The Ultimate Guide]](jpg/payroll-for-small-business-owners-768x432.jpg)