While plenty of people disagree on the wisdom of using credit cards, I do recommend using them if you can follow some key guidelines. If you are new to the world of credit cards, this post is for you. I’ll walk you through every important aspect of credit card usage, starting with the best credit cards available today that I use personally.

Credit cards can be a valuable tool for individuals and business owners alike. If you are going to use credit cards, it’s essential to understand how credit cards work and the best ways to use them. Here are the best.

What are the Best Credit Cards Right Now?

Here are the cards I’m using along with their bonus offer, reward points, and annual fee. I’ve rated the card from zero to five. All are great cards, but some are better than others. Look below the chart for my reason for the ratings.

Earn up to 100,000 Bonus Points

After you spend $15,000 on purchases in the first 3 months after account opening

Earn 125,000 Bonus Marriott Bonvoy Points

After you use your new Card to make $5,000 in purchases within the first 3 months of Card Membership

150,000 Hilton Honors Bonus Points

Earn 150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the Card within your first 3 months of Card Membership

Earn $200 Back

After you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership. You will receive the $200 back in the form of a statement credit.

That's $900 Toward Travel. Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening; that's $900 when redeemed for travel through Chase Ultimate Rewards®. $550 Annual fee; $75 for each authorized user.

My Personal Credit Cards

My favorite for personal use is still the Chase Sapphire Reserve (60k bonus points). Yes, it has a ridiculously high annual fee, but you get much of that back in credits, and the value you get with Ultimate Rewards bonus spending plus transferability makes it a no-brainer for me.

The upfront bonus is still nice too. Use my link below, and I’ll get some nice points as well.

My secondary personal card is the Arrival Plus Mastercard by Barclaycard (which is closed to new applicants). I use it for personal travel expenses that can’t be purchased with points (like Airbnb or train travel) because of the reward credits, or I use it when I need a Mastercard (vs Visa).

I also have an old personal credit card that I keep alive with small subscriptions: the Chase Freedom card. Finally, I have the American Express Blue Cash Everyday card, which I use for rental property expenses.

My Business Credit Cards

For business use, I use a mix of Chase Business cards and a couple of hotel branded cards.

The three primary Chase Business cards I use are the Ink Business (no longer available), Ink Business Plus (no longer available), and the Ink Business Preferred (which is still available to applicants).

The Ink Business Preferred is my go-to card for advertising spend. We spend around $25k for advertising my conference business. This card gives me 3x the ultimate rewards points for that spend.

Finally, I’m in the event industry, so I use these two cards for those expenses, depending on the hotel we are utilizing for our event: Marriott Bonvoy American Express and Hilton Honors American Express.

The Marriott Bonvoy card is just okay, but it does give me 6x points for any spending at a Marriott property. Which, if you’re spending over $50k annually that’s a nice heap of points.

The Hilton Aspire card has more value for me. It has 14x points for my spend. And it also has a $200 annual credit for airline fees (including the early bird check-in fee on Southwest, which I love having).

Both cards do come with annual fees that are negated by an annual free night award.

Beginner’s Guide to Credit Cards

Table of Contents

How to Find the Perfect Credit Card for You

How do you find a credit card? Choosing a credit card can be tough with all the options available to you. How do you find one that will fit your needs and match up well with your habits?

One thing is for sure. You don’t want the credit card companies telling you which card to use. Being intentional about your choice will end up producing the best result for you.

So how do you go about finding the best card for you and your situation? Here’s what I do:

- Stick to my principles

- Know my needs: short and long-term

- Analyze the various factors

Let’s dig into those a little bit deeper.

1. Stick to Your Personal Credit Card Principles

When you’re dealing with credit cards or any financial product, for that matter, it’s good to have a set of principles to fall back on.

I sometimes call it my “credit card philosophy.” Your principles will help you establish a bare minimum for accepting a credit card.

Some principles I have when it comes to cards are:

- use cards with no annual fees (unless there is strong evidence to get a card with a fee)

- interest rates don’t matter because I pay them off each month

- avoid all retail store cards

If you don’t trust yourself with credit, then, by all means, skip credit cards and keep using your cash, debit cards, or a charge card.

Some people like to keep it simple and have just one card. They value simplicity versus optimization.

Others find it valuable to have multiple cards, for different types of situations. Only you know your credit card principles. Use those to help guide your choice.

2. Know Your Credit Card Needs

The next step is to take a quick inventory of your needs for this new credit card. Where will you use the card? How often? Will your situation change from year to year? Is this for personal or business purposes?

For us, we see the long term value in a “daily spending” type card. One that will give us cash back for regular purchases (fuel, groceries, etc.) on a consistent basis for many years to come.

If you travel a lot and plan to use your credit card for travel needs, you probably have a different set of needs than that of someone who’s looking to use a card for daily spending.

Related: How to Travel Cheap Using Credit Card Rewards

If you simply need a credit card in the short term to do a 0% balance transfer, your needs are going to be completely different.

It’s also valuable to think about your long-term needs for a card. You can always cancel a card after your short-term goals are met. But if you can combine a card’s value in both the short and long-term, then you’ve really got a great card.

A good example of this is a balance transfer card that has a nice reward system. Once you’re done with the transfer then you can use it as a reward building card. But watch out for increases in interest rates, even if you do pay the card off in full each month.

You may be an entrepreneur looking to build your business credit. Nav can provide sound advice on which credit card would work best for your business. In addition, they offer free credit score updates for both your personal and business credit scores. Business credit can impact your ability to secure financing or to get low-interest rates on loans, so be sure to monitor that information carefully to protect your business.

3. Analyze the Credit Card Factors

Now that you’ve considered your principles and understand your needs, both short and long-term, you are free to compare credit card offers based on various credit card factors.

The factors to include in your analysis could be some combination of those listed below.

Sign-Up Bonus

Many cards offer attractive sign-up bonuses. Sign-up bonuses are where you can really earn a lot of points/cash quickly. Some of the best credit cards offer bonuses of 50,000+ points.

To put that in perspective, at 1 point per $1 spent, you’d need to spend $50,000 before you could earn 50,000 points. Even if you earned double points for every $1 spent, it would take $25,000 in spending to earn that many points.

Yet, some sign-up bonuses require you to spend as little as $500 to $1,000 within your first three months with the card. For this reason, if two cards offer similar ongoing earnings potential, the sign-up bonus for each could be the deciding factor.

You do need to be careful with sign-up bonuses in one regard, though. While many have reasonable minimum spending requirements, some are fairly high. Don’t chase after a sign-up bonus if you can’t meet the minimum spending requirement while keeping your normal spending habits.

Value of Points

One cent per point is considered a general credit card rewards baseline. Using the 1 cent per point guideline, 25,000 points would be worth $25o in cash or travel.

But not all points and miles are created equal. Some points are worth less than 1 cent, while others can be worth much more than 1 cent. A massive sign-up bonus from one card could actually be worth less than a more modest sign-up bonus from another card that has more valuable points.

There are many point valuation systems to be found online. Check a few of them out before choosing a card.

Earnings Potential

Big sign-up bonuses are nice. But how many rewards will you be able to earn with your credit card on an ongoing basis?

There are two main ways that credit cards allow cardholders to earn rewards. The first is to give extra rewards for spending on “bonus categories” and give 1 point per $1 spent on everything else. Every card is different, but typically credit cards offer 2x to 6x points on bonus category purchases. Popular bonus categories include:

- Restaurants

- Flights

- Hotels

- Car rentals

- Gas

- Business expenses (for business credit cards)

Other credit cards forgo the bonus categories and instead give extra rewards on all purchases. Depending on the card that you choose, you could get up to 2% back on all spending with a flat-rate credit card.

If you spend a lot of money on certain categories like travel or gas, you may want to look at a card that gives a big bonus for those expenses. Otherwise, a flat-rate card may be a better fit.

Also, pay attention to bonus category spending caps. For instance, a card that offers 2% on all purchases with no spending cap may be worth more than a card that offers 5% up to a $6,000 cap. This could especially be true if you are planning on using your credit card for business expenses.

Redemption Flexibility

How many ways you can redeem points? Some cards only allow you to redeem points toward one thing, like airfare or cash. Other cards, however, offer ultimate flexibility allowing you to choose between redeeming your points for airfare, hotels, rental cars, gift cards, cash, or even merchandise.

Also, pay attention to available travel partners as this can add even more redemption flexibility to your credit card rewards. Chase Ultimate Rewards points, for example, can be transferred to a multitude of travel partners like Hyatt or Southwest. The Citi ThankYou Rewards program includes a good number of travel partners as well.

Related: 10 Tips to Become an Expert in Credit Card Travel Hacking without Getting into Trouble

0% Intro APR Period

Are you looking to finance a large purchase? Cards with 0% intro APR periods can help with that. Many of the best credit cards come with 12 to 18 months of 0% interest.

Be careful, though, of “no interest if paid in full” periods (also called “deferred interest periods”.) These types of promotions tend to be popular with home improvement credit cards.

With deferred interest periods, you pay no interest if your card balance is paid off completely before the end of the promotional period. Otherwise, all the interest that accrued during the deferred interest period will be added to your balance.

When possible, choose credit cards that offer a true 0% APR intro period. And if you do choose a deferred interest card, make sure that you pay it off before your promotional period closes.

Acceptance

Is this a card that’s accepted in most stores? What about overseas?

If you do a lot of international travel, this could influence your decision. For instance, Visa and Mastercard are typically safer bets for overseas travel than American Express and Discover.

Balance Transfers

If you owe a balance on one or more credit cards with a high APR, it could save you a lot of money to transfer your balance to a new credit card that offers a 0% APR period. Dropping your APR from 15% or more to 0% could help you apply a lot more of your monthly payment towards principal.

Do be aware that most credit cards charge a balance transfer fee. The balance transfer fee on many credit cards is 5% of the amount transferred. But some of the best balance transfer cards offer a 3% intro balance transfer rate.

I’m sure I’ve left out a few factors, but those should get you started. Slap the relevant factors down on a spreadsheet or notepad and evaluate the cards available to you. Once you’ve performed the three steps above you should be in a comfortable spot to make a decision on a specific credit card.

Related: How to Organize Your Credit Cards and Conduct a Full Audit With This Simple Tracking Spreadsheet

Credit Cards 101

Used wisely, credit cards can play a big role in personal finance. Most smart people I know do one of two things with credit cards: either they don’t touch them at all, or they use them to their advantage.

How can a credit card be a positive piece of your financial portfolio? First, find the right card. Then, make sure you handle it properly:

- Pay it in full each month

- Maximize your cash back and rewards

- Watch out for fees

Over time you will rack up rewards and your credit history should improve.

I know a lot of people don’t care for credit cards, including some of my readers. Many people use their credit cards as if they’re free money, not fully recognizing that they have to pay back the charges. But if you have the self-control to use credit cards wisely, I think they have their place.

I see credit cards as simply another financial tool, like life insurance or a Roth IRA. They’re just an instrument to make things happen financially. It’s all in how you treat them.

Used wisely, they’re better, and probably safer, than any debit or prepaid card.

What Is a Credit Card Limit?

When you are given a credit card, you are assigned a credit card limit. This is the highest balance you can spend on the card.

Anything spent above this amount will incur an over-the-limit fee. Your initial credit card limit is based on your income and credit history.

Are There Cards Without a Limit?

Some credit cards do not come with a limit. The American Express charge card, for instance, doesn’t allow you to carry your balance forward. For that reason, you don’t really have a limit on your spending within the month.

After all, you’ll be paying it all off. What do they care how much you spend? However, I’ve heard that although there is no stated, pre-set limit, you will receive a notification when you’ve reached a “soft” limit, based on your history of spending with the card.

How a Credit Card Limit Affects Your Credit Score

One of the factors involved with calculating your FICO credit score is your “amounts owed.” This is judged based on the amount owed compared to the amount available.

Therefore, if you have a high credit card limit, any balance you carry will pale in comparison to your high limit. It’s recommended that you keep your balance to 30% of your overall limit. Having a higher limit will help your credit score.

Related: Improve Your Credit with our Ultimate Guide to Credit

How to Raise Your Credit Card Limit

Considering the effect the credit card limit has on your credit score, you might want to try and raise it to its highest level.

Credit card companies will naturally raise your limits over time as your payment history builds up. But you can also call them and request a credit limit increase.

Make sure you ask them to only do a “soft pull” of your credit history. A hard pull can negatively impact your credit score. Some online portals allow you to do this as well. Takes just a few minutes and could really help your score.

Related: Check Your Business Credit Score

Basic Tips for Good Credit Card Use

If you plan on using a credit card, here are a few tips to keep in mind to make sure you have the best experience possible. Most credit cardholders don’t use their cards to their full advantage. If you are not following these simple rules, you’re missing out.

1. Know Your Credit Card Terms

You may say to yourself, “who reads those terms? I don’t need to read the credit card terms.” Yep, it’s boring, but it’s a necessity.

There is a lot of fine print involved with a credit card. At the very least, turn over your credit card statement and review the following:

- Annual percentage rate (APR)

- Other APR

- Variable-rate information

- Grace period for purchases

- Balance calculation method

- Annual fees

- Minimum charges

- Specific transaction fees (cash advance and balance transfer)

- Late payment and over-limit fees

Of course, make sure you know your credit limit and any cash advance limits.

2. Review Your Charges

When you get your first credit card statement in the mail, you’ll want to make sure that the APR applied to your balance is the APR that you were given when you were accepted.

You also will want to review your individual charges (just as if you were reviewing your bank statement) to ensure there is nothing unexpected.

Lastly, look for any changes that the credit card company might be making. This could be a change in the interest rate or fees. It only takes a moment and not taking this time to check could lead to unexpected charges later.

3. Protect Your Credit Card Number

Protections for credit card use are getting stronger every day. However, it’s still important to keep your number under wraps.

Make sure you never share your credit card number with anyone. And if you use it to purchase something online, be sure that the website you are dealing with is reputable. Check out Privacy.com as an additional way to protect you when making online purchases.

Since your credit card statements usually have your full card number printed out, consider keeping them in a safe, shredding them, or going to online statements. Many of us now elect online-only credit card statements, which helps eliminate the paper trail.

4. Keep Your Balance Well Below the Credit Limit

Be sure you aren’t maxing out your credit cards: using all of your available credit balance. Credit utilization is a factor in determining your credit score.

You want to keep the amount of credit used well below the amount of credit you have. This is per card, and across all cards. The recommended card utilization is 30%, which means if you have a $10,000 limit you’ll want to keep your balance under $3,000.

5. Always Pay Your Balance in Full and on Time

This is a basic tip, but I can’t repeat it often enough. Credit cards are unsecured debt that carries a higher interest rate than a home or auto loan. And unlike a home mortgage or a school loan, the interest you pay cannot ever be tax-deductible.

There are few things as cool as earning a free flight from a reward card. But those miles aren’t really free if you’re paying higher interest rates. Paying your credit cards bill on time is also the factor that influences your credit score the most.

For all these reasons, you need to take it very seriously. Don’t wait till the last minute each month to make your payment. Instead, get it taken care of as soon as possible. And if you’re someone who has a forgetful streak, setting up automatic payments with your credit card issuer may be a smart move.

If you do set up automatic payments, you’ll still want to check your statement each month for any errors. And keep in mind that it often takes one or two billing cycles before automatic payments kick in. In the meantime, you’ll need to continue making manual payments.

6. Know Your Statement Closing Date

Your billing cycle lasts a month, and all charges made within that period must be paid in full by the next due date to avoid interest. When you know your statement cycle’s closing date, you can make large purchases the day after in order to receive another 30 days of an interest-free loan.

7. Take Advantage of Rewards!

If you do pay your balance in full every month, you must earn rewards. Not carrying credit card debt means that you are handling your finances well and even receiving a free loan from your card issuer. Don’t just pat yourself on the back, earn as many rewards as possible from your credit cards.

One caveat of credit card rewards: don’t spend more than you need to just for the sake of earning more rewards! This defeats the purpose of a rewards card. However, as long as you can stick to spending only what you would normally spend. A credit card isn’t a license to overspend.

I’ve lost track of all the award flights, free hotel stays, and cash back that I have earned since I started getting serious about maximizing my credit card rewards. Yet I still see people leaving valuable rewards unclaimed by using a non-reward card that they pay off each month.

If your rewards can equal 2-5% of your spending, how much are you giving up?

Related: 10 Tips to Become an Expert in Credit Card Travel Hacking without Getting Into Trouble

Reasons to Avoid Store Credit Cards

There are a lot of different types of cards. From small business credit cards to co-branded airline cards. But one type of card I encourage you to stay away from is the retail store credit card.

One of my very first jobs was selling retail at a store in the mall. Working usually helps your finances, but that job was one of the causes of my issues with debt. It’s hard to resist buying new things when you spend the workday surrounded by advertising and sales displays.

Self-control becomes even more difficult when you can be instantly approved for a store credit card. I could only give my spiel about the “benefits” of our card so many times before signing up myself.

I paid for that mistake for quite a while.

I’ve become wiser about finances in the years since then, but still can’t go into a store without being solicited to sign up for a credit card. There is always some type of incentive, but is it ever a good idea to sign up for a store-branded credit card?

The short answer is: no. The cons to store credit cards easily outweigh the temporary perks that come with signing on the dotted line. These are the top reasons why you should almost always dismiss the sales pitch and avoid signing up for store credit cards.

1. High-Interest Rates

Most types of credit cards average around 16% APR. Store credit cards, on the other hand, are usually well in excess of 20% APR. Stores can easily afford to give you 10% or even 15% off your first purchase because they will make it all back if you don’t immediately pay off your balance.

Also, the high-interest rates for store credit cards tend to be a standard number for everyone. This means that even if you have a great credit score, it will not provide you with any benefit when it comes to the interest rate for store credit cards.

2. Increased Spending & Debt

Odds are that you’re in the store with plans to make a purchase. Then, they offer you a discount on your total purchase that day, if you sign up for a store credit card.

Once approved, who is actually going to stick with just one or two items? The people who are duped into signing up for the store credit cards are also going to buy a bunch of extra things to “take advantage” of the one-time deal.

Not to mention the fact that they now have available credit to use, keeping cash in their wallets (at least for the time being.)

As the holder of a store-branded credit card, you will start receiving emails and mailings to keep you up to date on every new promotion. The stores may also send you special coupons. These could tempt you to spend even more.

It is all too easy to get caught up in the moment and be distracted by the “deals.” People forget how they will have to pay back every penny that they spend. And when they don’t, the balances will continue to grow thanks to the large interest rates.

3. Restricted Use

You are not going to see any of the typical credit card symbols on a store-branded one. That is because they are only good for that specific store.

You may be able to use it for different locations, but don’t bother trying to buy groceries with one of your mall credit cards.

Multiple credit cards mean a thicker wallet, more due dates to keep track of, and more bills in the mail.

4. Credit Score

As store cards can only be used for one retail location, you will need numerous cards to do all of your shopping. The big problem with this (besides an overflowing wallet) is that too many applications will temporarily hurt your credit score.

More importantly–and you may not realize this–credit scores are calculated, in part, on a comparison between your account balance and the amount of available credit.

Store cards usually have low credit limits. If you carry a balance on these cards, it will negatively affect your credit score because of the low percentage of available credit.

5. Impulse Decisions

Quick decisions rarely tend to be good ones. As someone who previously cajoled customers into signing up for store cards, I remember the quick and streamlined process.

Once someone agreed to apply, you wanted them signing off right away. You didn’t want to give them time to read the fine print or reconsider.

And don’t be too proud about being approved for a store card–almost everyone is approved. It usually takes more time to convince someone to apply for a card, than it does to get them approved.

6. You Will Likely Lose Money On Interest & Late Fees

It’s easy to rationalize that you’ll pay off the total amount due on your credit cards each month, but it doesn’t always happen.

Stores know that the odds are in their favor when it comes to credit cards. A large percentage of customers who sign up for cards will be paying them off for some time to come.

Forgetting to pay the bill on time could cost you as much as $30 for a late fee. The amount lost on a minor discount or coupons is quickly regained by the stores as you carry a balance and/or make a late payment.

Which Cards Should You Sign Up For?

What credit cards should you sign up for? Try a card that actually gives you long-term rewards. Travel rewards cards are a good example. These types of cards can be used all over the world and have lower interest rates.

Also, instead of receiving coupons or discounts that encourage additional purchases, you can score free plane tickets or stays at hotels. As always, the key to benefiting from the use of credit cards is not spending more money than you can afford to pay back.

Credit card debt can be a huge problem, but it can be avoided by paying off your balance every month. Only then do you benefit from the incentives offered by a credit card company.

What to Do if You’re Declined for a Credit Card

Have you ever heard the expression “It doesn’t hurt to ask?” This sentiment is never truer than when it comes to credit cards.

Too often, cardholders think the big banks are monolithic institutions whose decisions regarding its account holders are set in stone.

In fact, nothing could be further from the truth. If you’re declined, ask the card company to reconsider your application. Remember when, as a child, you would ask one parent for something only to appeal to your other parent when your request was rejected?

Although you have (hopefully) grown out of using that tactic, it actually works when applying for a credit card.

The Benefit of Talking to a Human Being

You see, nearly all credit card issuers rely on their computer systems to evaluate the credit score of new applicants before making a decision. At the same time, they allow you to contact an actual human being to discuss any rejection.

It turns out that their customer service representatives do have the power to reconsider your credit card application. Sometimes it is just a matter of a person correcting a computer’s poor decision, but other times it may involve closing another existing account or moving a line of credit.

And if you don’t get the answer you are looking for the first time, just call back again and speak with someone else. You won’t get into trouble.

More Things You Should Ask the Card Companies For

1. Bump Your Bonus

Let’ say you apply for and receive a new credit card only to find out that there was a better sign up bonus available for that card. Or, what if a larger signup bonus offer appears shortly after you apply?

It sounds too good to be true, but you can actually contact your bank and ask to receive the better offer.

To use the bank’s terminology, just ask if you can “apply the other offer code to my account.” They will know what you are talking about and they often have the power to make the switch.

2. Forgive Late Fees

I would like you to believe that as a credit card expert, I have never made a late payment. But of course, I have, if only by mistake. Yet I can truthfully say that I have never actually paid a late payment fee.

The trick is to merely call the bank, admit your mistake, and ask to have the late fee waived. Considering that banks pay hundreds of dollars in marketing, advertising, and sign-up bonuses just to attract one new customer, they are delighted to retain an existing card member merely by writing off a small fee.

3. Offer You a Retention Bonus

Not only will banks forgive fees to retain new customers, but they will also offer you a bonus if you threaten to cancel. Just call the bank, tell them that you are thinking about closing your account, and ask to speak with a retention specialist.

That person will search their systems to find an offer designed to keep you as their customer. This could involve bonus points, miles, or cash back. In other instances, they might even waive your annual fee.

4. Just About Anything

Do you know someone that you can call that will do just about anything you ask them? Even if you do, are they available 24/7? Amazingly, this is a service that is provided by a large number of different credit cards.

For example, Visa has its Signature Concierge program that will provide you with directions, help you make travel plans, or recommend a restaurant. Similarly, MasterCard has its World Elite Concierge program, and most American Express cards offer some form of travel and shopping assistance.

So stop accepting the dictates of your credit card issuer and start demanding more. After all, it doesn’t hurt to ask.

Common Questions About Credit Cards

Below, you’ll find the answers to the most common credit card-related questions.

What Should You Do When Your Credit Card is Lost or Stolen?

I was hanging out with a friend recently when he realized he had misplaced his credit card. He called the restaurant he was dining at last night. Luckily, they had his card.

He also called his card company to ensure there had been no fraudulent charges made on the card. He was in the clear. I told him he shouldn’t have had as many glasses of wine with dinner. 🙂

Credit Card Customer Service Hotlines

Here’s a list of the numbers to call for each major card issuer to report your lost credit card.

Note: With most of these numbers, they will ironically ask you for your card number. However, I’ve tried to list below what other options you have, or how to just get to a person to talk to.

- Chase: 1-888-269-8690; From outside the US: 1-480-350-7099

– You will need to wait for the prompts for the card number to pass. Then when they ask for it, enter the last four digits of your social security number - Discover: 1-800-DISCOVER; From outside the US: 1-801-902-3100

– Press #, then press 2 - Citi: 1-800-950-5114

– Press 0 - American Express: 1-800-528-4800

– Say “report a lost or stolen card.” Then say, “I don’t have it” if you don’t know your card number

In the Case of Fraud, What Charges Are You Liable For?

It’s definitely important to call your credit card company as soon as possible once you realize your card is lost or might have been stolen. The person with access to your card could be running up a bunch of charges.

So what happens if they spend $500 on the card before you call your credit card company? Well, luckily we have the Fair Credit Billing Act, which, as I understand it, says you are only liable for up to $50 in fraudulent charges. However, most banks will waive that $50 liability so you’ll most likely not be responsible for any fraudulent charges.

Also, once you call your credit card issuer and inform them of the lost or stolen card, you are no longer liable for future fraudulent charges. For more information see the FTC’s Facts for Consumers page on the Fair Credit Billing Act. Make note of the requirements to mail in a letter as well.

Is a Credit Card Cash Advance a Bad Financial Move or Good Emergency Plan?

A cash advance using a credit card is similar to using your ATM card. Instead of a debit or check card, you use your credit card and credit card PIN at the ATM to withdraw funds.

Unlike a debit or check card withdrawal where you’re actually using your own money, with a credit card cash advance you are using borrowed funds, made available to you through your credit agreement.

The amount you can withdraw depends on your overall credit limit, your daily cash advance limit, as well as any overall cash advance limit that the card company may apply. As you can see, cash advances are a pretty convenient way to get quick cash.

However, these types of withdrawals are discouraged because of the high rate of interest applied to these balances, associated fees, and the method with which some card companies use to incur interest and apply for payments.

Cash advances can also come in a second form: checks. You’ve probably received these checks in the mail before. If you were to use these checks for anything, they would essentially be the same as doing a cash advance through an ATM.

How to Find Your Credit Card Cash Advance Fee and Interest Rate

It’s important to understand how these types of transactions will be handled. As you’ll see, it’s not the most advantageous financial move you can make.

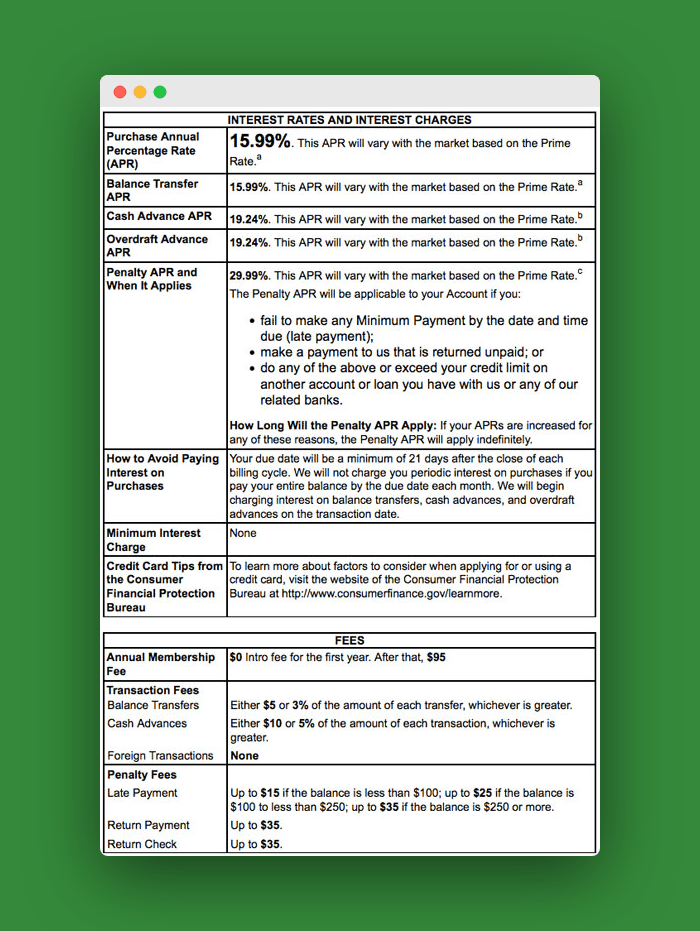

Let’s take a look at an example Schumer Box to see some of the fees and rates to be applied to these cash advance transactions.

To find your Schumer Box, look on your credit card statement, or with those cash advance checks you’ve received. This example shows the rate that will be applied to any cash advances that you use. As you can see, the rate is higher than the normal purchase rate.

Towards the bottom of the box, you can see the fees associated with cash advances. As you can see, with that type of fee, you can quickly be paying a lot just to use this type of transaction.

More Credit Card Fees to Watch Out for

You also need to watch out for any ATM fees that you’ll incur during the withdrawal.

In addition to fees, you need to understand that usually, interest charges for cash advances begin when you make the withdrawal. There is no grace period like for purchases. However, the card company will apply your payment to that first since it has the highest rate.

Tips for Making the Most of a Cash Advance

If you’re going to use a credit card cash advance, make sure it’s under these circumstances:

- You fully understand your credit card terms and know what fees you’ll incur, your limit, and how the balance will be paid off

- You’re using a card with a $0 balance

- You use a no-fee ATM

- You can pay it off fast

Alternatives to the Credit Card Cash Advance

There are several other ways to get cash quick. You can get cash by returning things, consignment shops, peer-to-peer lending, an equity line of credit, among other things.

Most of those ideas are a better alternative than the credit card cash advance. But none provide the truly last-minute, immediate, emergency cash that you might need when you don’t have your debit card.

How Do You Opt-Out of Credit Card Offers?

One of the things that may be piling up in your house is a stack of offers to sign up with a new credit card or lower your insurance.

While these are great financial tools, you may not want to know about them every day in the form of a junk-filled letter.

You should sign up for credit cards when you want to, right? Not when the credit card company wants you to. Here’s how to opt-out of all those credit card offers:

Use an Opt-Out Service

Visit a website called OptOutPrescreen.com and sign up for their five-year or permanent opt-out service. It’s free and your right under the Fair Credit Reporting Act.

Also, if you want to get rid of general junk mail, DMAchoice.org is where you can opt-out of general marketing mail. DMAchoice represents about 80% of the total volume of marketing mail in the United States. So you’ll be getting rid of a lot of mail by signing up with them.

Both services are free.

Call the Bank or Credit Card Issuer

Now, what this doesn’t do is stop the junk mail that comes from your bank or your current credit card providers. Don’t you hate those annoying cash advance checks?

To get rid of these mailings, call your bank or credit card company directly. While you’re at it, why not sign up for electronic statements as well?

Regarding opting out, I know this isn’t for everyone. There are some benefits to getting offers in the mail. You can use these offers to negotiate lower rates on your current credit cards, find the best cash back credit cards, or find a really nice 0% APR deal. But you can always shop online to see what banks are offering at that time.

Just keep that in mind when deciding on whether to opt-out or not.

::

Credit cards can provide tremendous benefits and value. When you take full advantage of them, you can earn lots of rewards that can be converted into cash, free travel, gift cards, and more.

But credit cards can also be a curse when they tempt you to overspend and rack up interest charges. But you can maximize the pros of credit cards and minimize the cons by following the “good credit card use tips” provided in this guide.